It calculates the annual yield for a security that pays interest at maturity.

The syntax of the function is the following:

YIELDMAT(settlement, maturity, issue, rate, pr, [basis])

settlement: The settlement date of the security (It is the date when the security is traded to the buyer and it always comes after the issue date).

maturity: The maturity date of the security.

issue: The issue date of the security.

rate: The annual interest rate of the security at the date of issue.

pr: The security’s price per $100 face value.

[basis]: Optional. The type of day count basis (default is 0).

If the dates entered are not valid dates the function returns a #VALUE! error.

If pr or rate are less than or equal to zero the #NUM! error is returned.

If basis is not inside the valid values (between 0 and 4) the #NUM! error is returned.

If the settlement date is after the maturity date the #NUM! error is returned

Click on the button to practice using this function, with the help of our Online Assessment Tool:

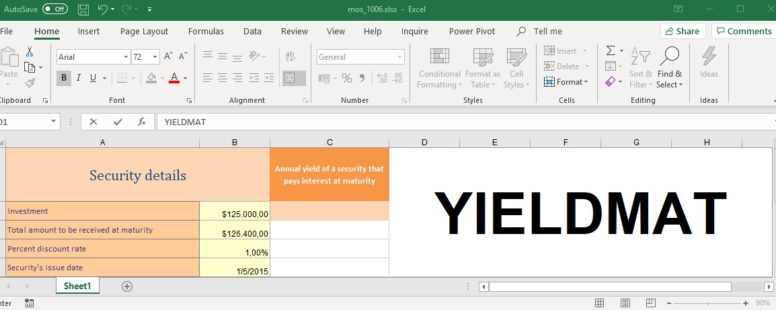

Here is an example of how to use the YIELDMAT function:

Use the proper function in the cell C2, to calculate the annual yield of a security that pays interest at maturity. All the information you need is displayed in the current worksheet.